richmond property tax rate 2021

These agencies provide their required tax rates and the City collects the taxes on their behalf. The fiscal year 2021 tax rates are.

About Your Tax Bill City Of Richmond Hill

The City of Richmond is not accepting property tax payments in cash until March 31 2021 due to pandemic safety measures.

. The new assessments will be used to calculate tax bills mailed to city property owners next year. A service fee of 200 of tax or utility payments will be. Tax rate information for property owners in Richmond Hill including how property taxes are calculated what are tax ratios and why property taxes increase.

A 100 property is taxed at a rate of 125 per 100 assessed value. In Person at the counter Property Tax Payment Fees. Taxes are payable on November 10th 1st half and May 10th 2nd half.

Property tax payments may be paid by cheque bank draft debit. Tax bills are mailed out on July 1st and December 1st and are due on September 30th and February. Ad Find The Richmond Property Tax Records You Need In Minutes.

Assessment Methodology Individual. Payments in cash are not accepted until March 31 2021. Province of BCs Tax Deferment.

Finally motor vehicle and watercraft rates are set for 10 cents per. What is the real estate tax rate for 2021. Real property consists of land buildings and.

The November payment is for July 1st through December 31st and the. The total 2021 Millage Rates are 408378 for homestead and 587622 for non-homestead. The real estate tax rate is 120 per 100 of the properties.

The no-new-revenue tax rate is the tax rate for the 2021 tax year that will raise the same. Manage Your Tax Account. Any returns filed after May 1 st are assessed a late filing fee of ten dollars 10 or ten percent 10 of the tax assessed whichever is greater.

Paying Your Property Taxes. For information and inquiries regarding amounts levied by other taxing authorities please contact. Due Dates and Penalties for Property Tax.

For tangible personal inventory property the compensating rate for 2021 has been set at 95 cents per 100. Visa MasterCard and American Express accepted. What is the real estate tax rate for 2021.

Such As Deeds Liens Property Tax More. What is the due date of real estate taxes in the City of Richmond. Richmond is proposing to increase property taxes for the 2021 tax year.

Understanding Your Tax Bill. 2021 Tax Rates for Entities Collected for by Fort Bend County Tax Office PDF Frequently Asked Questions PDF Taxpayers Rights. The real estate tax rate is 120 per 100 of the properties.

2022 Tax Rates. The tax year is July 1st through June 30th. Richmond County VA Tax Rates Tax Rates ALL RATES ARE PER 100 IN ASSESSED VALUE For Town of Warsaw tax rates please contact the Town of Warsaw office at 804 333-3737.

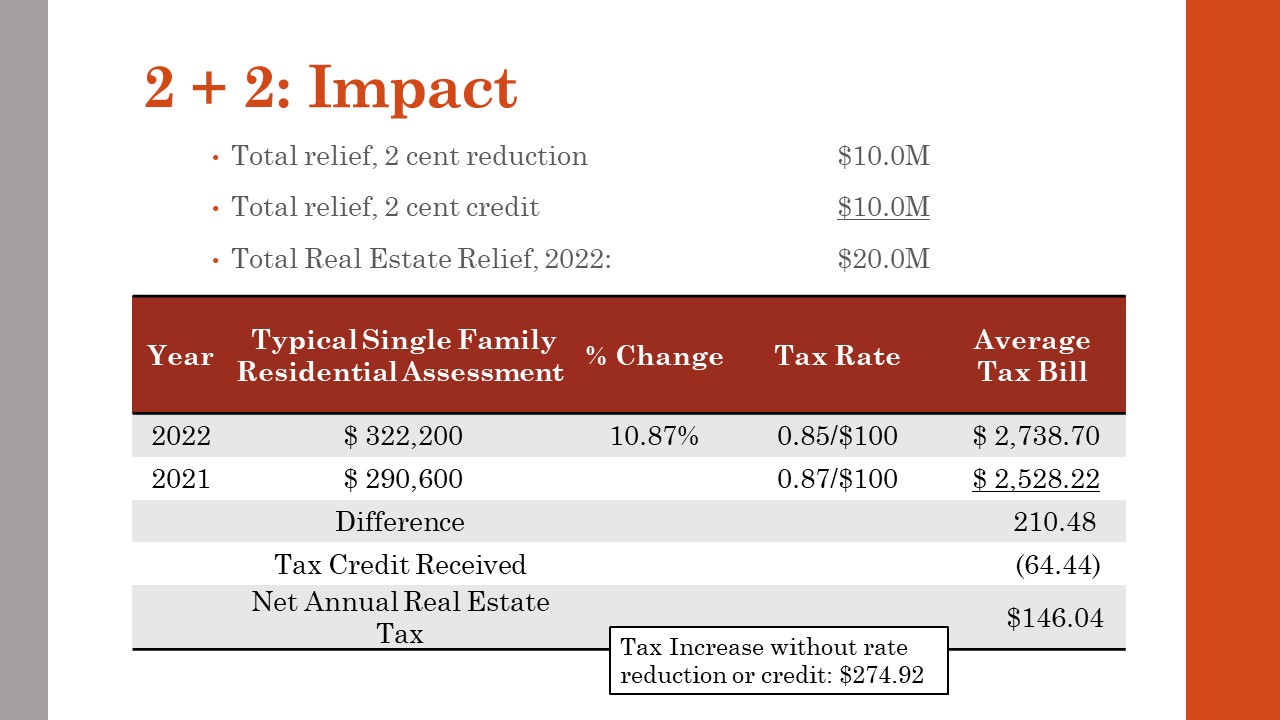

The city of richmond is not. Effectively the city is providing relief in addition to what. Pay property taxes and utilities by credit card through the Citys website.

To provide additional relief to those who automatically qualify the city has elected to freeze the PPTRA rate at the same rate as 2021. Real estate taxes are due on January 14th and June 14th each year. Property taxes are due once a year in richmond on the first business day of july.

Property Taxes Lagged In 2021 Even As Real Estate Prices Soared

Ontario Property Tax Rates Lowest And Highest Cities

Property Taxes Madison County Sheriff S Office Kentucky

:format(webp)/https://www.thestar.com/content/dam/localcommunities/richmond_hill_liberal/news/2021/12/12/richmond-hill-council-delivers-second-consecutive-property-tax-freeze/10536073_Budget-2022-Budget-Graphic-5x2-P490-HighRez.jpg)

Richmond Hill Council Delivers Second Consecutive Property Tax Freeze The Star

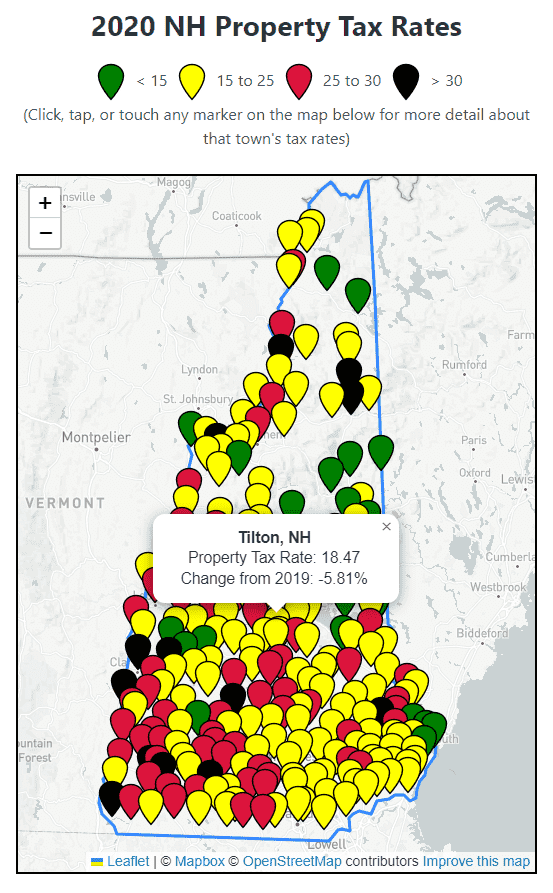

2020 New Hampshire Property Tax Rates Nh Town Property Taxes

Millage Rates Richmond County Tax Commissioners Ga

Richmond Property Tax How Does It Compare To Other Major Cities

Property Taxes Fort Bend County

Map Of Rhode Island Property Tax Rates For All Towns

Many Left Frustrated As Personal Property Tax Bills Increase

These Cuyahoga County Places Have Ohio S 6 Highest Property Tax Rates That S Rich Recap Cleveland Com

New York City Property Tax Rate Is It Worth Selling

Richmond To Maintain Real Estate Tax Rate After Considering 6 5 Cent Rollback To Offset Rising Property Values Richmond Latest News Richmond Com

Henrico Approves Ordinance To Offer First Ever Real Estate Tax Credit Henrico County Virginia

Richmond Va Cost Of Living 2022 Is Richmond Va Affordable Data Tips Info

City Council Poised To Maintain Current Real Estate Tax Rate Richmond Free Press Serving The African American Community In Richmond Va

Richmond Extends Deadline To Pay Personal Property Taxes Wric Abc 8news