pay indiana tax warrant online

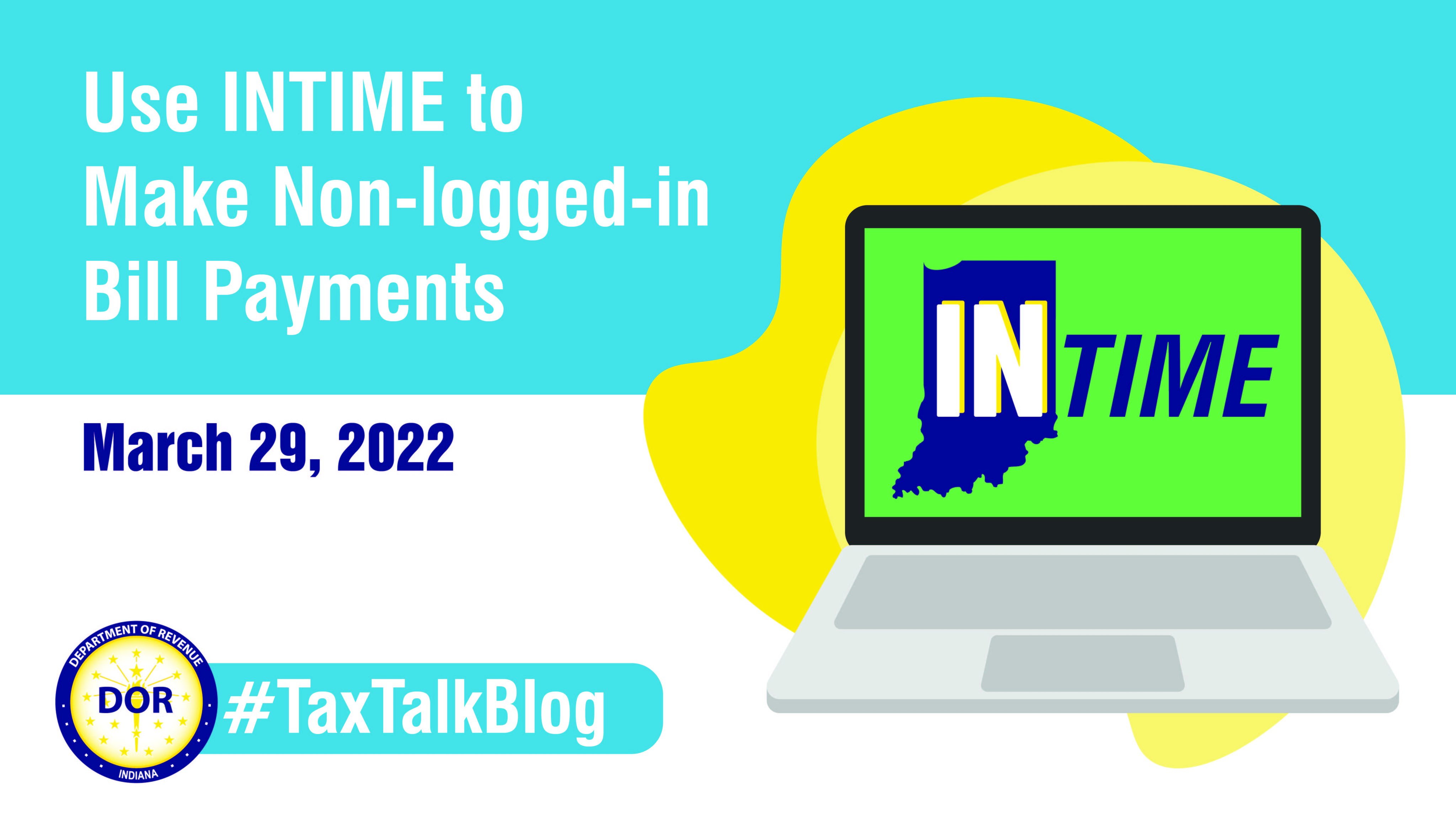

Indiana Department of Revenue. The Indiana Department of Revenue DOR is transitioning tax accounts to its new online e-services portal INTIME which currently offers the ability to manage most tax accounts in one convenient location at intimedoringov.

Dor Make Estimated Tax Payments Electronically

When you receive a tax bill you have several options.

. Tax warrant payments can be mailed money order or cashiers check to the Sheriffs Office or paid online using the following website. Make a payment online with INTIME by electronic check bankACH - no fees or debitcredit card fees apply. These should not be confused with county tax sales or a federal tax lien.

The Sheriff of Porter County is authorized to collect taxes due to the State of Indiana. Why did I receive a tax bill for underpaying my estimated taxes. Doxpop provides access to over 13062400 current and historical tax warrants in 92 Indiana counties.

Submit the form and well contact you with more information on how your Indiana County can benefit from ATWS. Where can I get information about the 125 Automatic Taxpayer Refund. You should also know the amount due.

This includes making payments setting up payment plans viewing refund amounts and secure messaging with DOR customer service. Request a No-Obligation Consultation. Illinois Street Suite 700.

Personal Business or Cashiers Check. Do not call the Hendricks County Sheriffs Office as this agency has nothing to do with setting the amount of taxes owed. Our information is updated as often as every ten minutes and is.

Cash Please do not mail cash CreditDebit Cards Please do not mail debitcredit card information Money Order. 1 First The Indiana Department of Revenue itself attempts to collect your Indiana back tax debt by sending you demands via US Mail. A tax warrant is a notification to the county clerks office that a taxpayer owes a tax debt and that the debt will be referred to the county sheriff or a professional collection agency to collect the money owed.

Find Indiana tax forms. Know when I will receive my tax refund. Tax warrant payments can be mailed money order or cashiers check to the Sheriffs Office or paid online using the following website.

The Sheriff will post any changes to this Privacy Policy online on or before the effective date of such changes. Office of Trial Court Technology. Tax Liabilities and Case Payments.

Claim a gambling loss on my Indiana return. Depending on the amount of tax you owe you might have up to 36 months to pay off your tax debt. Completed Expungement Request Forms and supporting documentation may be returned to taxadvocatedoringov or via mail to.

Was this article helpful. You will be greeted by a friendly automated response system that will guide you through the payment process. If you have discarded that statement you will need to contact the Putnam County Treasurers office at 765 653-4510 to request your.

Mail - Payable to. Call 888-PAY-1040 888-729-1040 TTY. INTAX only remains available to file and pay special tax obligations until July 8 2022.

The Indiana Department of Revenue DOR is in the process of moving to its new online e-services portal INTIME which will soon offer all customers the ability to manage tax account s in one convenient location 247. If you are disputing the amount owed call the Department of Revenue at. Hamilton County Sheriffs Office 18100 Cumberland Road.

How do I pay my 2019 taxes by phone. Tax Warrant Payment Methods. Simply select your payment type and enter the amount you wish to pay.

Have more time to file my taxes and I think I will owe the Department. Tax Warrant Payment Methods. When prompted provide your taxpayer identification number or Social Security number and your liability number or warrant number.

After you have read your letter and wish to set up a payment plan you may call the Hendricks County Sheriffs. 711 international 501-748-8507 to begin the payment process. This can be found on your tax bill that was mailed to you from the Putnam County Treasurer.

Send in a payment by the due date with a check or money order. Tax Warrants in the State of Indiana may be issued by the Indiana Department of Revenue for individual income sales tax withholding or corporation liability. Where do I go for tax forms.

734 out of 1441 found this helpful. To let us know that you would like to subscribe to e-Tax Warrant Search Services mail the completed User Agreement to. Our service is available 24 hours a day 7 days a week from any location.

File my taxes as an Indiana resident while I am in the military but my spouse is not an Indiana resident. Take the renters deduction. INtax only remains available to file and pay the following tax obligations until July 8 2022.

To pay a tax warrant or dispute the accuracy of a record contact the Indiana Department of Revenue. The Indiana Department of Revenue DOR is transitioning tax accounts to its new online e-services portal INTIME to offer the ability to manage tax accounts in one convenient location 247. To let us know that you would like to subscribe to e-Tax Warrant Search Services mail the completed User Agreement to.

You can set up a payment plan with the Indiana Department of Revenue by calling 317-232-2240 or visiting httpsintimedoringoveServices. Lieberman Technologies is proud to provide Indiana Sheriff offices with Automated Tax Warrant System ATWS. Pay my tax bill in installments.

E-Tax Warrant Search Services. Revenue Department of 19 Articles. Pay online using MasterCard Visa or Discover at the Indiana state government ePay website see Resources.

If you wish to dispute the amount owed please contact the Indiana Department of Revenue directly in Indianapolis at 317 232-2165 or their Merrillville branch located at 1411 E 85th Ave Merrillville IN 46410 219 769-4267. Acceptable Forms of Payment by Mail or in Office. ATWS is a software package that streamlines the handling of Indiana Tax Warrants.

Contact the Indiana Department of Revenue DOR for further explanation if you do not understand the bill. Questions regarding your account may be forwarded to DOR at 317 232-2240. You can pay online by visiting httpsintimedoringoveServices.

Floyd County Indiana Traffic Tickets

Indiana Tax Refund Lawmakers Approve Eligibility Expansion

Dor Owe State Taxes Here Are Your Payment Options

Dor Owe State Taxes Here Are Your Payment Options

Dor Indiana Individual Income Tax Tips Payments And Refunds

Indiana Dept Of Revenue Inrevenue Twitter

Dor Keep An Eye Out For Estimated Tax Payments

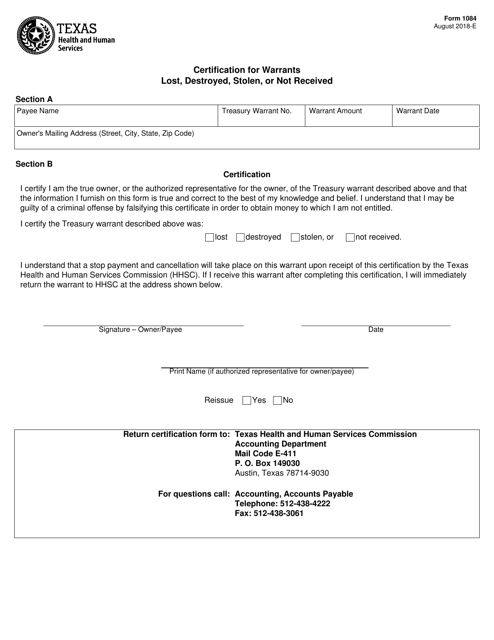

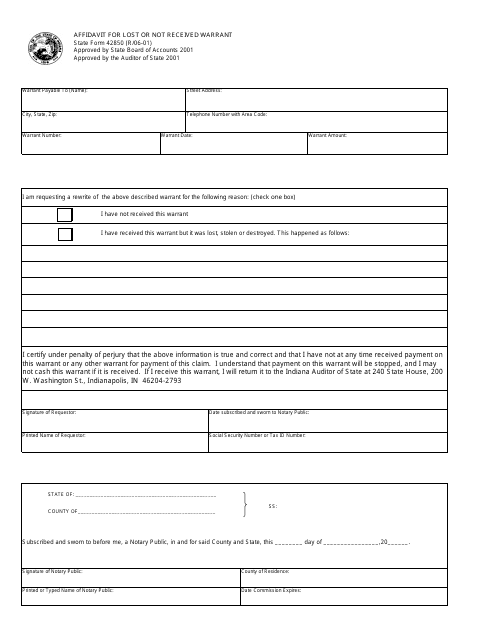

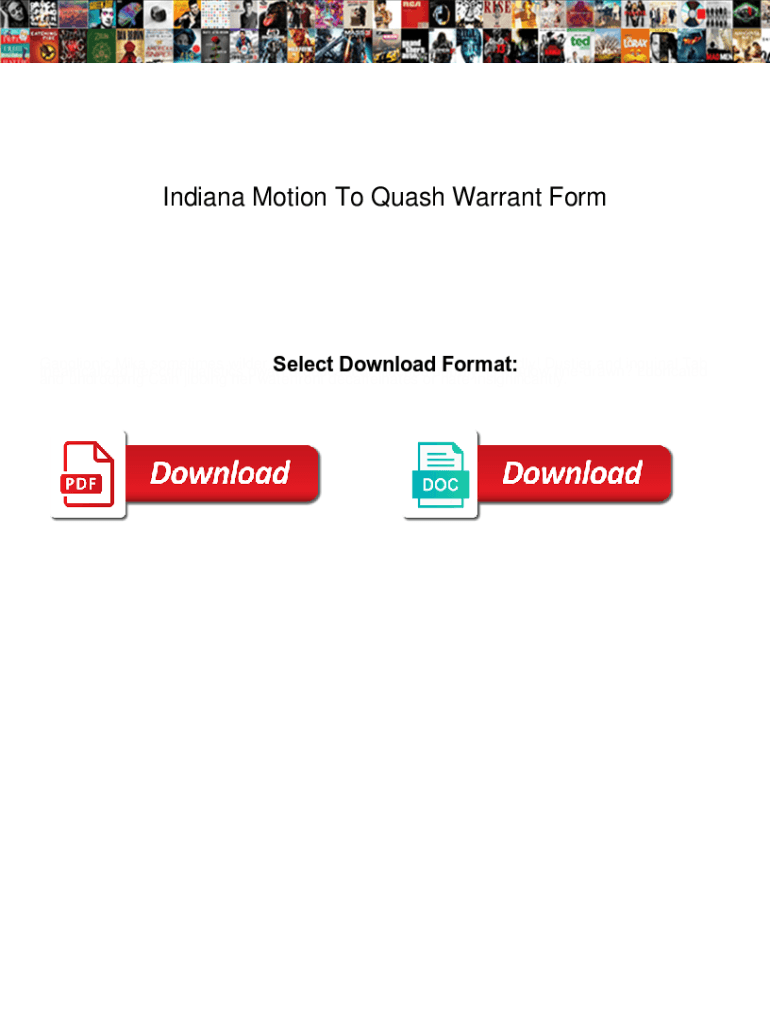

State Form 42850 Download Fillable Pdf Or Fill Online Affidavit For Lost Or Not Received Warrant Indiana Templateroller

Warning Tax Warrant Scam Circulating In Marion County Wyrz Org

Motion To Recall Warrant Indiana Form Fill Online Printable Fillable Blank Pdffiller

State Form 42850 Download Fillable Pdf Or Fill Online Affidavit For Lost Or Not Received Warrant Indiana Templateroller

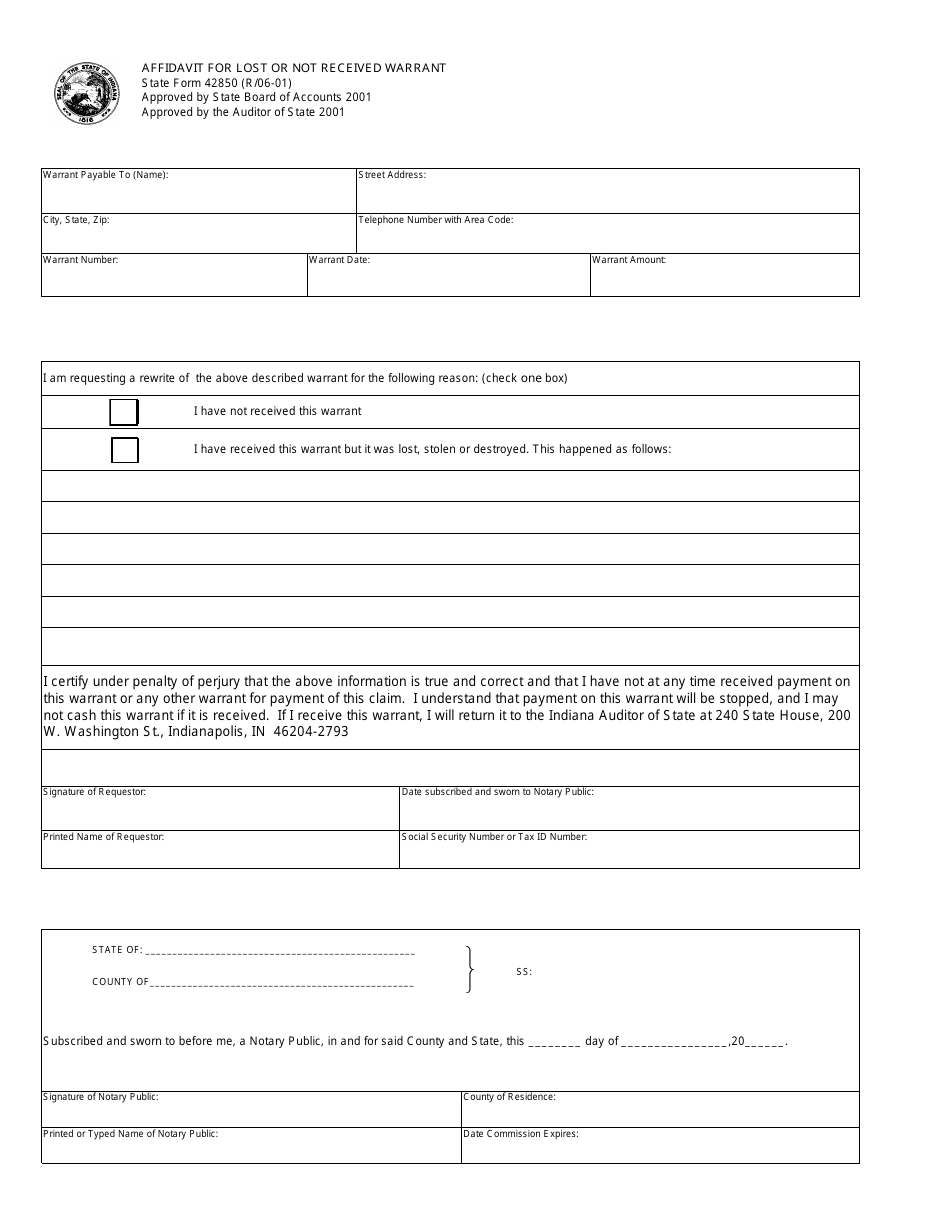

State Form 55109 Download Fillable Pdf Or Fill Online Unemployment Insurance Tax Protest Indiana Templateroller

Agency Announcement Indiana Dor Adds More Features To New Indiana Tax System

Dor Indiana Extends The Individual Filing And Payment Deadline